Ethics Through Current Developments (12-03-2022)

Today’s Important Articles for Geography (12-03-2022)

Today’s Important Articles for Pub Ad (12-03-2022)

WSDP Bulletin (12-03-2022)

(Newspapers, PIB and other important sources)

Prelim and Main

- Innovative tech creating unprecedented disruption in banking sector: Khara READ MORE

- Govt tightens IPO valuation scrutiny, jolts startups eyeing listings: Report READ MORE

- India, China hold 15th round of military talks READ MORE

- India, Canada to reboot trade agreement talks READ MORE

- Border, forest officials seize live pangolins, deer horns on Bihar-Nepal border READ MORE

- US officially designates Qatar as a major non-NATO ally READ MORE

- Kerala Budget: New IT park proposed in Kannur, 4 IT corridors READ MORE

Main Exam

GS Paper- 1

- The mystery of an ancient Hindu-Buddhist kingdom in Malay Peninsula READ MORE

- Alternatives for Secure Adaptation and Mitigation Strategies READ MORE

GS Paper- 2

POLITY AND GOVERNANCE

- Electoral democracy vs constitutional democracy: Post-poll lessons READ MORE

- Seeking Succour READ MORE

- Critical Importance of Cooperative Federalism READ MORE

SOCIAL ISSUES

- Explained: What is manual scavenging, and why is it still prevalent in India? READ MORE

INTERNATIONAL ISSUES

- Double trouble: Nato and the EU are not overly excited about granting membership to Ukraine READ MORE

GS Paper- 3

ECONOMIC DEVELOPMENT

- More jobs can shock-proof the Indian economy. Unemployment allowance can be cushion for now READ MORE

- India is making a mistake by increasing contract labour instead of quality jobs READ MORE

- Behind India’s Lowest Female Labour Force Participation Rates in the World READ MORE

- Negotiating Disciplines on Fisheries Subsidies at the WTO: Sustaining the Blue Economy READ MORE

ENVIRONMENT AND ECOLOGY

- India used more coal power in 2021 than 2020, which could delay its climate goals: IEA READ MORE

- The Irreversibility of Change in Climate READ MORE

SCIENCE AND TECHNOLOGY

- Shutdown this misguided energy policy: The vulnerabilities of reactors and their high costs are strong reasons why India must cancel its nuclear expansion plans READ MORE

- Towards a composite tech evolution: Technology impacts life anywhere and everywhere READ MORE

SECURITY

- Arms lobbies rip S Asia with forced weaponry sales READ MORE

GS Paper- 4

ETHICS EXAMPLES AND CASE STUDY

- Is it easier to be unhappy than to be happy? READ MORE

- Rebalancing ecology, economics & ethics READ MORE

Questions for the MAIN exam

- Our economy is a subset of ecology, and therefore, to save ecology, we must be ethical in our economic activities. In the light of the statement, discuss how our activities can be balanced between ecology, economics, and ethics?

- ‘In urban India, India should empower local governments to meet their adaptive capacities and support them in preparing their disaster atlas to ensure minimum damage to lives and assets’. Discuss the statement.

QUOTATIONS AND CAPTIONS

- True humility is not thinking less of yourself, it is thinking of yourself less.

- The women here have taught the entire society to live with harsh natural challenges, taught to fight and taught to win.

- It is imperative that to achieve sustainable development, the broken harmony between economy, ecology and ethics be restored.

- Understanding that our economy is a subset of our ecology is critical. It is therefore vital that human behaviour toward nature be modified and corrected. To achieve this, ecology and ethics need to work in tandem.

- Climate-resilient development should be commensurate with social justice.

- Strengthening the “cooperative” element of our federal structure is the key factor in formulating the fiscal relationships in the Indian economy.

- India needs to revisit its urban planning strategy, which should be people-centric. Simultaneously, it should empower local governments to meet their adaptive capacities and support them in preparing their disaster atlas to ensure minimum damage to lives and assets.

- This indicates a severe ‘time poverty’ for women who in the process of balancing might be required to give up on rest and leisure, with severe consequences for their physical and emotional well-being.

- The existing policies in India are not universal across all sectors of the economy and are dogged by exclusions. A commitment to gender equality, after all, is the nazariya that is most needed now and ever.

- Presidential intervention shapes and defines that vital ‘consequential disturbance’, just as the lack of it signifies the waste of that power and more importantly, responsibility.

50-WORD TALK

- New Delhi’s admission that a malfunction led to the firing of a cruise missile into Pakistan will cause justified global concern. In nuclear-weapons environments, annihilation is just one accident or misperception away. Full, transparent investigation is necessary. India and Pakistan must begin a serious dialogue to reduce nuclear risks.

Things to Remember:

- For prelims-related news try to understand the context of the news and relate with its concepts so that it will be easier for you to answer (or eliminate) from given options.

- Whenever any international place will be in news, you should do map work (marking those areas in maps and also exploring other geographical locations nearby including mountains, rivers, etc. same applies to the national places.)

- For economy-related news (banking, agriculture, etc.) you should focus on terms and how these are related to various economic aspects, for example, if inflation has been mentioned, try to relate with prevailing price rises, shortage of essential supplies, banking rates, etc.

- For main exam-related topics, you should focus on the various dimensions of the given topic, the most important topics which occur frequently and are important from the mains point of view will be covered in ED.

- Try to use the given content in your answer. Regular use of this content will bring more enrichment to your writing.

DAILY CURRENT AFFAIRS (MARCH 11, 2022)

THE SOCIAL ISSUES AND SOCIAL JUSTICE

1. INDIA HAD THE HIGHEST MORTALITY OF ANY COUNTRY DURING PANDEMIC: LANCET STUDY

THE CONTEXT: According to the new study published by the Lancet, as many as 4.07 million people in India are estimated to have died during the COVID-19 pandemic in 2020 and 2021.

THE EXPLANATION:

- This analysis attempted, for the first time, to estimate excess deaths during the COVID-19 pandemic worldwide.

- It has determined that 18.2 million people in 191 countries have died since March 2020 – versus 5.94 million officially recorded deaths.

- Overall, it suggests that India had the highest mortality of any country during the pandemic.

- This is eight times more than the number of COVID-19 deaths India has officially registered. Even now, the official toll is only 0.5 million.

- The second worst-hit country is reportedly the US, with 1.13 million deaths in 24 months – 1.14-times more than its officially recorded deaths. Five more countries had excess deaths exceeding 0.5 million in this period: Russia, Mexico, Brazil, Indonesia, and Pakistan.

- These seven countries together account for more than half of all excess deaths due to COVID-19 in the 191 countries.

State-wise scenarios

- According to the analysis, eight states in India had mortality rates exceeding 200 deaths per 100,000 people. Only 50 other countries in the world, of the 191, had worse mortality during the pandemic. These states were Uttarakhand, Manipur, Maharashtra, Chhattisgarh, Haryana, Himachal Pradesh, Punjab and Karnataka (in descending order).

- On the other hand, Arunachal Pradesh, Andhra Pradesh, Telangana, Sikkim, Rajasthan, Gujarat, Uttar Pradesh, Jharkhand, West Bengal and Goa had excess mortality rates lower than the global average – of 120.6 per 100,000 people.

- In terms of the absolute number of estimated deaths, Maharashtra topped the chart in India with 0.6 million. Bihar came second with 0.3 million.

- Also the study noted, “the magnitude of disease burden might have changed for many causes of death during the pandemic period due to both direct effects of lockdowns and the resulting economic turmoil”.

THE SCIENCE AND TECHNOLOGY

2. EXPLAINED: WHAT IS XENOTRANSPLANTATION?

THE CONTEXT: In a landmark surgery in January 2022, doctors replaced the heart of a 57-year-old patient with the heart of a genetically altered pig. However, the patient died two months after the operation

THE EXPLANATION:

The experimental procedure was done after the US Food and Drug Administration (FDA) granted emergency authorization for it on December 31, 2021. The patient had been ruled ineligible for a conventional heart transplant or an artificial heart by major transplant centres.

WHAT IS XENOTRANSPLANATATION?

- According to the FDA, xenotransplantation is “any procedure that involves the transplantation, implantation or infusion into a human recipient of either (a) live cells, tissues, or organs from a nonhuman animal source, or (b) human body fluids, cells, tissues or organs that have had ex vivo contact with live nonhuman animal cells, tissues or organs”.

- Xenotransplantation is seen as an alternative to the clinical transplantation of human organs whose demand around the world exceeds supply by a long distance.

The First Instance,

Xenotransplantation involving the heart was first tried in humans in the 1980s. A well-known case was that of an American baby, Stephanie Fae Beauclair, better known as Baby Fae, who was born with a congenital heart defect, and who received a baboon heart in 1984.

Why the heart of a pig?

- Pig heart valves have been used for replacing damaged valves in humans for over 50 years. There are several advantages to using the domesticated or farmed pig as the donor animal for xenotransplantation.

- The pig’s anatomical and physiological parameters are similar to that of humans, and the breeding of pigs in farms is widespread and cost-effective. Also, many varieties of pig breeds are farmed, which provides an opportunity for the size of the harvested organs to be matched with the specific needs of the human recipient.

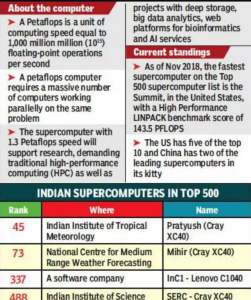

3. “THE PARAM GANGA”-A PETASCALE SUPERCOMPUTER

THE CONTEXT: National Supercomputing Mission (NSM) has deployed PARAM Ganga, a supercomputer at Indian Institute of Technology (IIT) Roorkee, with a supercomputing capacity of 1.66 petaflops.

THE EXPLANATION:

- The availability of such a supercomputer will accelerate the research and development activities in multidisciplinary domains of science and engineering with a focus to provide computational power to the user community of IIT Roorkee and neighbouring academic institutions.

- The system is designed and commissioned by C-DAC under phase-2 of the build approach of the NSM. Substantial components utilized to build this system are manufactured and assembled within India along with an indigenous software stack developed by C-DAC, which is a step towards the Make in India initiative of the government.

- C-DAC has been entrusted the responsibility to design, development, deployment and commissioning of the supercomputing systems under the build approach of Mission. The Mission plans to build and deploy 24 facilities with cumulative compute power of more than 64 Petaflops.

National Supercomputing Mission (NSM)

- The Mission envisages empowering our national academic and R&D institutions spread over the country by installing a vast supercomputing grid comprising of more than 70 high-performance computing facilities.

- The four major pillars of the NSM, namely, Infrastructure, Applications, R&D, HRD, have been functioning efficiently to realize the goal of developing indigenous supercomputing eco system of the nation.

- The National Supercomputing Mission (NSM) which is being steered jointly by Ministry of Electronics & Information Technology (MeiTY) and the Department of Science and Technology (DST) and implemented by Centre for Development of Advanced Computing (C-DAC) and Indian Institute of Science (IISc), Bangalore, has progressed significantly.

Value Addition:

What are Super Computers?

A supercomputer is the fastest computer in the world that can process a significant amount of data very quickly. The computing Performance of a “supercomputer” is measured very high as compared to a general purpose computer. The computing Performance of a supercomputer is measured in FLOPS (that is floating-point operations per second) instead of MIPS. The supercomputer consists of tens of thousands of processors which can perform billions and trillions of calculations per second, or you can say that supercomputers can deliver up to nearly a hundred quadrillions of FLOPS.

Applications:

Common applications for supercomputers include testing mathematical models for complex physical phenomena or designs, such as climate and weather, evolution of the cosmos, nuclear weapons and reactors, new chemical compounds (especially for pharmaceutical purposes), and cryptology.

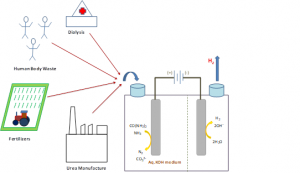

4. SCIENTISTS DEVELOP ENERGY-EFFICIENT HYDROGEN PRODUCTION BY UREA ELECTROLYSIS

THE CONTEXT: Indian Scientists have designed an electrocatalyst system for energy-efficient hydrogen production with the help of electrolysis of urea. The urea electrolysis is helpful towards urea-based waste treatment with low-cost hydrogen production. This can be utilized for energy production towards our country’s benefits.

THE EXPLANATION:

Hydrogen Production by Urea electrolysis

- The energy requirement for production of hydrogen through water electrolysis can be reduced by 70 % through urea electrolysis.

- The energy-intensive counterpart of water splitting, oxygen evolution, can be replaced with urea oxidation in urea electrolysis. The low-cost, earth-abundant Ni-based catalysts are widely applied for this process.

- The main challenge associated with urea oxidation is retaining the prolonged activity of the catalyst as the strong adsorption of the reactive intermediate (COx) on the active site, referred to as catalyst poisoning, causes activity loss.

Methodology:

- The scientists have explored electrocatalysts and shown that surface defective NiO and Ni2O3 systems having more Ni3+ ions are more efficient electrocatalysts than conventional NiO. They have used high-energy electron beams to produce surface defective unsaturated Ni sites in NiO (e-NiO).

- The study reveals that e-NiO prefers direct mechanism of urea electro-oxidation due to strong adsorption of urea molecule, whereas NiO favors indirect mechanism with low activity. Further, the prominent electrocatalyst poison COx could be removed by adjusting the molar ratio of KOH and Urea with improved kinetics.

What is the significance of the production of hydrogen by Urea electrolysis?

India is one of the top countries in urea production, and it produced 244.55 LMT of urea during 2019-20. The nitrogenous fertilizer industries generate a high concentration of ammonia and urea as effluents. Hence, this can be utilized for energy production towards our country’s benefits.

THE PRELIMS PERSPECTIVE

5. NARI SHAKTI PURASKAR’ – 2020 AND 2021

THE CONTEXT: The President of India, has conferred the ‘Nari Shakti Puraskar’ for the years 2020 and 2021, on the occasion of International Women’s Day on March 08, 2022, at Rashtrapati Bhavan, New Delhi.

THE EXPLANATION:

Overall, 29 women have been conferred the award for the years 2020 and 2021 in recognition of their outstanding and exceptional work towards the empowerment of women, especially the vulnerable and marginalised. There was a total of 28 awards which included 14 awards each for the years 2020 and 2021. The award ceremony for the year 2020 could not be held in 2021 due to the COVID-19 pandemic.

Value Addition:

- Every single Nari Shakti Puraskar is disturbed among the deserving individuals and institutions on 08th March every year. The announcement of the award is made by the Ministry of Women and Child Development.

- Nari Shakti Awards 2022 is distributed in six institutional categories: Rani Lakshmi Bai Award, Rani GaidinliuZeliang Award, Mata Jijabai Award, Kannagi Devi Award, Devi Ahilya Bai Holkar Award & Rani Rudramma Devi Awards and two individual categories: For courage and bravery & For making outstanding contributions to women’s endeavour, community work, or making a difference, or women’s empowerment.

- It is the highest civilian award for women, which is given to deserving women because of their good deeds in the field of women empowerment.

6. EXERCISE “DHARMA GUARDIAN”-INDIA AND JAPAN

THE CONTEXT: Exercise Dharma Guardian, an annual exercise between Indian Army and Japanese Ground Self Defence Force, concluded at Belgaum with a focus on counter-terrorism operations and disruptive technologies between two key partners in the Indo-Pacific region.

THE EXPLANATION:

- Dharma Guardian is an annual military exercise that is being conducted in India since 2018.

- It has covered a vast spectrum – from cross training and combat conditioning in the field environment to sports and cultural exchanges. The contingents from the two armies jointly attended demonstrations at the firing ranges and also participated in various tactical exercises. Both contingents shared their expertise on contemporary subjects of counter-terrorism operations, as also on exploiting disruptive technologies such as drone and anti-drone weapons.

Other Joint Exercises with Japan

- SHINYUU Maitri: This is a bilateral exercise conducted between the Japanese Air Self Defence Force (JASDF) and the Indian Air Force.

- JIMEX: It is a bilateral maritime exercise held between Japan and India.

- Sahayog-Kaijin: A joint bilateral exercise between the Japan Coast Guard and the Indian Coast Guard.

THE PRELIMS PRACTICE QUESTIONS

QUESTIONS OF THE DAY 11TH MARCH 2022

Q1. Consider the following statements:

- Assertion (A): Craters on the moon are of a more permanent nature than that of Earth.

- Reason (R): There is absence of atmosphere and plate tectonics on(in) the moon whereas both are present on(in) Earth.

Select the correct answer from the following:

a) A is true, but R is false.

b) A is false, but R is true.

c) A is true and R is the correct explanation of A.

d) Both a and R are not correct.

ANSWER FOR 10th MARCH 2022

Answer: D

Explanation:

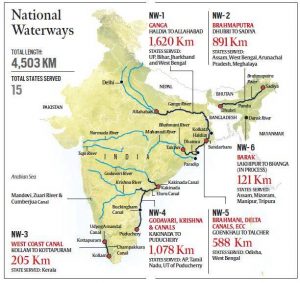

- Please refer to given map-

REINVENTING THE REGULATORY ROLE OF THE SECURITIES AND EXCHANGE BOARD OF INDIA IN THE AFTERMATH OF NSE SAGA

THE CONTEXT: On February 11, 2022, the Securities and Exchange Board of India (SEBI) passed an order involving the country’s largest stock exchange-The National Stock Exchange. Apart from highlighting the issue of corporate misgovernance, the whole episode has raised questions on the role of the capital market regulator. In this article, we examine the issue in detail.

ALL YOU NEED TO KNOW ABOUT THE NSE IMBROGLIO

THE SEBI FINDINGS:

- The National Stock Exchange (NSE)’s former Managing Director (MD) and Chief Executive Officer (CEO) is penalized for misusing her office for:

- making appointments,

- concealing confidential information about operations of the exchange,

- and making incorrect and misleading submissions to the Securities and Exchange Board of India (SEBI).

- The regulator states that her unknown spiritual guru influenced her decision-making.

- The former NSE Chief is also being examined for a case registered in May 2018 about alleged abuse of a trading software of the exchange and the SEBI order comes in this backdrop (Read Ahead).

IMPROPER PERSONNEL MANAGEMENT:

- The former NSE head appointed a person as the Chief Strategic Officer (CSO) of the exchange despite the latter not having any exposure to capital markets.

- SEBI notes that the exchange had not advertised any vacancy about the appointment of CSO

- SEBI notes that his previous work experience was not relevant to his new consultancy position at NSE. With recurrent appraisals and performance ratings, his compensation rose to ₹4.21 crore within two years(1.8 crores when he joined)

DIVULGING CONFIDENTIAL INFORMATION:

- The regulator found the former NSE Chief guilty of divulging confidential information about the NSE’s organizational appointments, financial results and projections, dividend pay-out ratio, and board meeting consultations to her unknown spiritual guru.

FAILURE OF THE NSE BOARD:

The NSE Board was found guilty of not informing the market’s regulator and opting to keep it under wraps.

PENALTIES IMPOSED:

- The former NSE Chief has been forbidden from dealing in stocks, etc. for three years, alongside a penalty of ₹3 crores.

- The erstwhile CSO has been restrained from associating with any market infrastructure institution or an intermediary for three years. He would also have to pay a penalty of ₹2 crores.

- NSE has been ordered not to launch any new product for the next six months.

AN ANALYSIS OF THE NSE SCAM?

BLOW TO CAPITAL MARKETS:

- The NSE is a Market Infrastructure Institution that provides facilities for trading stocks and other products in the capital market.

- The scam has sent alarm bells to the investors and trading community and even has the potential to undermine the economic security of the nation apart from hugely denting investors’ confidence.

- The government has already indicated that it will initiate measures to sustain investors’ confidence in the Indian capital market.

POOR CORPORATE GOVERNANCE:

- The approach by the Board of NSE amounted to a cover-up of the entire episode so that no outsider, including the regulator, would ever come to know.

- The public interest and shareholder directors collectively decided to not document the board discussion concerning the irregularities of the management, thereby abdicating their primary responsibilities.

- Instead of sacking her, the Board allowed her to resign with respectable compensation and buried the matter, reflecting the complete collapse of corporate governance in NSE.

REWARDING MALFEASANCE:

- The entire Board’s complicity is further indicated by the fact that, despite being aware that the MD-cum-CEO was divulging confidential information of the NSE to an anonymous individual and had recruited and excessively rewarded another individual, the Board allowed her to resign on December 2, 2016.

- For good measure, the Board placed on record her “sterling contribution and approved a 44-crore severance package!

CONDUCT OF DIRECTORS OF GOVT COMPANIES/BANKS:

- Senior executives of the LIC, the SBI group, and the Stock Holding Corporations, etc, are part of the BoD who are delegated to protect the interests of their companies. But they have not raised any alarm but went along with the questionable approach of the management.

- Their role highlights a troubling issue: when they are on the Board of prominent private sector companies, they apparently abandon their own companies.

- And it also seems they are ready to align themselves and take instructions from the executive management of the private sector companies. It raises questions for the public about how the parent companies themselves are managed.

REGULATOR’S CONDUCT:

- The SEBI’s order on the NSE saga and the delay of six years in concluding the probe raises troubling questions on the regulator’s role (Read Ahead)

A SERIES OF SCAMS IN NSE:

- The current scam comes in the backdrop of a progressing CBI-led investigation into the co-location scam and other glaring irregularities in NSEs.

- This points out that the NSE’s financial success and near-monopoly have clouded the judgment of the NSE leadership or they believe to be above the rule of law.

WHAT IS THE CO-LOCATION SCAM?

WHAT ARE CO-LOCATION FACILITIES?:

- There are dedicated spaces in the exchange building, right next to the exchange servers, where high-frequency and algo traders can place their systems or programs.

BENEFITS OF THESE FACILITIES:

- With the co-location facilities being extremely close to stock exchange servers, traders here have an advantage over other traders due to the improvement in latency (time taken for order execution).

- But the co-location is mainly used only by institutional investors and brokers for their proprietary trader. Retail investors have a negligible presence here.

UNFAIR ACCESS TO SERVERS:

- The scam in NSE’s co-location facility took place almost a decade ago. It was alleged that one of the trading members, OPG Securities, was provided unfair access between 2012 and 2014 that enabled him to log in first to the server and get the data before others in the co-location facility.

- It was alleged that the owner and promoter of said private company abused the server architecture of NSE in conspiracy with unknown officials of NSE, SEBI, etc.

- This preferential access allowed the algo trades of this member to be ahead of others in the order execution.

ROLE OF WHISTLEBLOWER AND MEDIA:

- The scam came to light due to a whistle-blower’s complaint to SEBI in 2015, in which the entire modus operandi of the people gaming the system was laid out.

- When Money life(a media outlet) exposed the scam, the NSE management adopted a high-handed attitude, slapping a ₹100 crore defamation suit against Money life.

- The matter moved to Bombay High Court, which came down hard on NSE and dismissed its suit. Further, NSE was told to pay ₹50 lakh as the penalty for its arrogant attitude in responding to the media.

EXTENT OF LOSS:

- The point to note is that there is no way of proving any loss to any investors or traders due to this scam. The SEBI order of 2019 directed OPG Securities and its directors to disgorge unfair gains of ₹15.7 core with the interest of 12 percent from April 7, 2014, as a national loss.

PENALTY ON NSE:

- In 2016, SEBI asked NSE to carry out a forensic audit of its systems and deposit the entire revenue from its co-location facilities into an escrow account. Deloitte was tasked with the job of conducting a forensic audit of NSE’s systems.

- In 2019, SEBI passed its order on the issue, asking NSE to pay ₹625 crores with an interest of 12 percent and also barred NSE from raising money from the stock market for six months.

CORRECTIVE MEASURES:

- NSE has changed its order execution protocol in the co-location facility to Multicast TBT from April 2014, thus plugging the loophole that allowed some to game the system.

THE SECURITIES AND EXCHANGE BOARD OF INDIA: AN OVERVIEW

CONSTITUTION OF SEBI:

- The Securities and Exchange Board of India was constituted as a non-statutory body on April 12, 1988, through a resolution of the Government of India.

- The Securities and Exchange Board of India was established as a statutory body in the year 1992 and the provisions of the Securities and Exchange Board of India Act, 1992 (15 of 1992) came into force on January 30, 1992.

PROTECTIVE FUNCTION OF SEBI:

- Checking price rigging

- Prevent insider trading

- Promote fair practices

- Create awareness among investors

- Prohibit fraudulent and unfair trade practices

REGULATORY FUNCTION OF SEBI:

- Designing guidelines and code of conduct for the proper functioning of financial intermediaries and corporate.

- Regulation of takeover of companies

- Conducting inquiries and audits of exchanges

- Registration of brokers, sub-brokers, merchant bankers, etc.

- Levying of fees

- Performing and exercising powers

- Register and regulate credit rating agency

DEVELOPMENT FUNCTION OF SEBI:

- Imparting training to intermediaries

- Promotion of fair trading and reduction of malpractices

- Carry out research work

- Encouraging self-regulating organizations

- Buy-sell mutual funds directly from AMC through a broker

OBJECTIVES OF SEBI:

- Protection to the investors: The primary objective of SEBI is to protect the interest of people in the stock market and provide a healthy environment for them.

- Prevention of malpractices: This was the reason why SEBI was formed. Among the main objectives, preventing malpractices is one of them.

- Fair and proper functioning: SEBI is responsible for the orderly functioning of the capital markets and keeps a close check over the activities of the financial intermediaries such as brokers, sub-brokers, etc.

POWERS OF SEBI:

- SEBI is a quasi-legislative, quasi-judicial and quasi-executive body.

- SEBI has the power to regulate and approve any laws related to functions in the stock exchanges.

- It has the powers to access the books of records and accounts for all the stock exchanges and it can arrange for periodical checks and returns into the workings of the stock exchanges.

- It can also conduct hearings and pass judgments if there are any malpractices detected on the stock exchanges.

When it comes to the treatment of companies, it has the power to get companies listed and de-listed from any stock exchange in the country. - It has the power to completely regulate all aspects of insider trading and announce penalties and expulsions if a company is caught doing something unethical.

GOVERNANCE OF SEBI:

- The SEBI Board consist of nine members-

- One Chairman appointed by the Government of India

- Two members who are officers from Union Finance Ministry

- One member from the Reserve Bank of India

- Five members appointed by the Union Government of India

ENFORCEMENT OF LAWS:

- SEBI enforces provisions of the SEBI Act, the Depositories Act 1996, the Securities Contracts (Regulation) Act, 1956, among others.

- A Securities Appellate Tribunal established under section 15-K of the Securities and Exchange Board of India Act hears appeal from the orders of SEBI which can be challenged in the SC only.

A QUESTION MARK ON SEBI’S REGULATORY ROLE

INEXPLICABLE DELAY:

- Though SEBI began investigations in 2016, it has taken six years to arrive at this order. However, SEBI’s order raises more questions than it answers as it has not taken the issue to a logical conclusion.

DILUTION OF OFFENCE:

- The order passed by SEBI’s whole-time member contains no provision for conducting any investigation into the possible criminal aspects of the then NSE Chief’s conduct.

- It appears that SEBI sees her criminal offense of sharing NSE’s internal confidential information with an unknown person as indiscretion.

- But converting a grave criminal offense into a regulatory indiscretion may set a dangerous precedent for the entire capital market ecosystem.

POOR CAPACITY OF SEBI:

- Multiple complaints were lodged in SEBI against the then NSE MD &CEO, which led SEBI to investigate her case.

- If SEBI lacked the capability or capacity to take the investigation further, it should have sought the assistance of other investigating agencies.

- The NSE Board chairman, upon discovering that Chitra was sharing information regarding NSE with her Himalayan Yogi, apprised the NSE Board members in a closed-door meeting. And that information was too sensitive to be even recorded in minutes of the board meeting.

NO FEAR FOR REGULATORS:

- NSE had knowledge that she shared sensitive information with the alleged yogi and NSE Board had concealed this information from SEBI Long after she had resigned, and only when SEBI probed, NSE directed Ernst &Young to figure out the identity of the alleged Yogi.

- The whole episode reflects poorly on the status and respect the SEBI commands or put in other words; the regulated seems to have scant regard for the regulator and seems to believe that the system can be gamed and they will never get caught.

LOST OPPORTUNITY FOR REFORMS:

- SEBI missed an opportunity to make an example of the CMD’s case as a warning to rogue managers. However, the meager penalty meted out by SEBI indicates the regulator is as keen as NSE to close the case rather than address the ethical and legal cracks within the system. The penalty imposed on her is ₹3 crore – less than 7% of her severance package of ₹44 crores.

SEBI’S FAILURE TO UPHOLD NATIONAL INTEREST:

- By relegating this case to a mere issue of breach of compliance, SEBI has effectively turned a possible criminal offense into a civil case. This case will embolden more who may now find it easier to abuse their official positions to compromise their own company’s integrity or hurt national interest.

ABDICATION OF AUTHORITY:

- Despite being armed with exceptional powers among financial regulators to summon market participants and to search and seize evidence, SEBI failed to show the intent to get to the bottom of the scam while the trail was still hot.

REVITALIZING THE REGULATOR AND REFORMING THE NSE: THE WAY FORWARD

SCALE UP THE RESOURCE BASE:

- SEBI as a regulator has to scrutinize millions of transactions done almost every minute in the stock market and that by itself makes its task herculean. The problem is compounded by the need to act swiftly, and naturally, there are limitations.

- Hence, the resource base of SEBI, especially human infrastructure, needs to be scaled up so also its technological capability through AI, etc.

FAST TRACK REFORMS IN NSE:

- A leading stock exchange like NSE is a systemically important institution as it serves an economic function and is the symbol of the free market. Any disruption in the NSE has a repercussion on the economy and the country.

- The NSE leadership needs to put their house in order by upholding the laws of the land and also by holding accountability of the management to the Board, which also need to be accountable to the public.

- Processes and practices currently in place at NSE need to be revisited so that such an event doesn’t re-occur at such an important market infrastructure institution.

ACTIONS BY SEBI:

- SEBI has also instituted various changes in the governance of market infrastructure institutions (MIIs), including board committee structures and oversights, the tenor of management, accountability for lapses at MIIs, etc., which can strengthen the control environment.

FULFILLING SEBI’S MANDATE:

- SEBI has been tasked with preserving the integrity of the capital market and institutionalizing good governance in the stock market ecosystem.

- For the sake of millions who trust SEBI to preserve the integrity of the Indian capital market, the regulator must fix the systemic deficiencies in the Indian exchange.

- It must not be seen as favoring or taking a soft approach to matters of regulatory violation, especially by powerful players.

EXPECTATION FROM THE NEW SEBI CHIEF:

- Regulating the stock exchanges independently and efficiently, especially when doubts have arisen regarding the functioning of the NSE, should be high on the list of tasks for the newly appointed chairperson of SEBI.

ROLE OF PMO AND OTHERS:

- The SEBI order itself seems incomplete and there seems to be something more than what meets the eye. This could require further investigation by other agencies, and the Finance Ministry and the Prime Minister’s Office need to act expeditiously.

- The CBI investigation into this scam also needs to be fast-tracked and should be done professionally to unearth the truth and to prosecute and punish the guilty.

REGULATING THE REGULATOR:

- The SEBI order has done more damage to its credibility and many questions have remained unanswered. Thus, a thorough inquiry into the investigation conducted by SEBI by independent agencies needs to be undertaken to find out if any extraneous considerations were involved in the manner of investigation or its findings.

- This does not in any way will deem to be an encroachment into the regulator’s autonomy but will be a step towards improving regulatory quality.

- Additionally, a Regulatory Impact Assessment needs to be conducted to assess the functioning of SEBI and the Parliament’s control over it needs to be strengthened through standing committee oversight, periodic reports, etc.

RESTRUCTURING THE BOARD OF NSE:

- Persons occupying key management positions at important institutions, even if professionals, should be rotated at reasonable intervals.

- Allowing an individual to turn into a permanent fixture as CEO or MD is a bad idea. It is improper for an outgoing CEO/MD to continue on the Board.

- And it is worse if this happens when the ex-CEO’s deputy assumes charge as the new CEO. Not only can this create situations of nexus, but it can also tie down the successor from initiating a clean-up of legacy structures.

WHISTLEBLOWER PROTECTION:

- As it was a whistle-blower letter that alerted SEBI to the irregularities at NSE, MIIs must be asked to put in place well-defined employee whistle-blower mechanisms, where complaints can be lodged directly with the concerned.

- The identity of the whistle-blower must be strictly protected to prevent vindictive action.

PROFESSIONAL CONDUCT OF THE GOVT COMPANY/BANK REPRESENTATIVES:

- The LIC is coming to the market for its initial public offering, and prospective shareholders and policyholders have a right to demand an explanation from LIC on the unprofessional conduct of its representatives on NSE in this period.

- Similarly, shareholders of SBI also should demand an explanation from SBI on the conduct of its officers when deputed as directors in other companies.

- The govt should take note of the negligence/irresponsibility of these members and stringent actions need to be taken against them if found to be complicit.

THE CONCLUSION: Despite the capture of power by a few individuals and the governance infractions they indulged in, few can dispute that the National Stock Exchange (NSE) has served Indian financial markets extremely well in the three decades of its existence. Its state-of-the-art electronic platform and reliable trading and settlement systems have ensured that there were no systemic failures through the worst of upheavals. It is therefore critical for the government and the regulator to get to work on fixing the loopholes in the governance structures at the NSE so that such infractions don’t recur. The regulator needs to introspect on its actions both in the co-location and ‘yogi’ scams and learn from the mistakes.

QUESTIONS:

- Stock exchanges as institutional mechanisms have an important role to play in ensuring the stability of the financial and economic system. But, the recent instances of misgovernance in India’s premier stock exchange have the potential to undermine the financial and economic security of the country. Elaborate.

- Who will regulate the regulator is a question that needs to be answered while balancing the imperatives of regulatory autonomy and accountability. Examine the statement in the context of the SEBI’s role in the recent National Stock Exchange scams.

- What do you understand by the term co-location in the context of capital markets? How far do you think that poor regulation by SEBI and questionable corporate governance at the National Stock exchange has contributed to it?

- The capital market regulator needs capital: human, financial, and technological. Comment

- When a regulatory authority combines legislative, executive, and judicial powers, there is bound to exist a lack of any meaningful accountability leading to arbitrariness in decision making which will defeat the purposes for which the regulator is created in the first place- fair play, competition, and facilitation. Critically examine.

ADD TO YOUR KNOWLEDGE

NSE was incorporated in 1992. It was recognized as a stock exchange by SEBI in April 1993 and commenced operations in 1994 with the launch of the wholesale debt market. NSE, set up after Harshad Mehta’s scam, is today the largest stock exchange in India in terms of trading volume and figures also in the top list of Asia’s stock exchanges.

The National Stock Exchange of India Limited offers a platform to companies for raising capital. Investors can access equities, currencies, debt, and mutual fund units on the platform. In India, foreign companies can raise capital using the NSE platform through initial public offerings (IPOs), Indian Depository Receipts (IDRs), and debt issuances. The NSE also offers clearing and settlement services.

NSE Functions

- To establish a trading facility for debt, equity, and other asset classes accessible to investors across the nation.

- To act as a communication network providing investors an equal opportunity to participate in the trading system.

- To meet the global standards set for financial exchange markets.