DAILY CURRENT AFFAIRS (FEBRUARY 03, 2022)

THE INTERNATIONAL RELATIONS

1. INDIA, NEPAL SIGN MOU ON CONSTRUCTION OF MOTORABLE BRIDGE OVER MAHAKALI RIVER

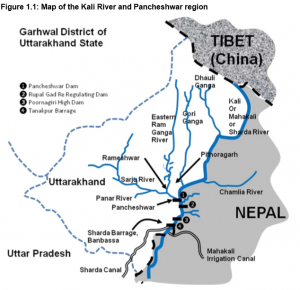

THE CONTEXT: India and Nepal signed a Memorandum of Understanding (MoU) for the construction of a motorable Bridge over the Mahakali River connecting Dharchula (India) with Darchula (Nepal), under Indian grant assistance.

THE EXPLANATION:

- Benefits: The project will improve cross-border connectivity between Nepal’s Sudur paschim province and India’s Uttarakhand state, where close people-to-people ties exist between communities on both sides of the border.

- This is in line with both governments’ shared goal of increasing cross-border connectivity to facilitate commercial, cultural, and people-to-people exchanges. The construction of the bridge is planned to commence soon.

India- Nepal Relations:

As close neighbours, both nations share unique ties of friendship and cooperation characterized by an open border and deep-rooted people-to-people ties of kinship and culture. The free movement of people across borders has a long history. Nepal has a border with five Indian states – Sikkim, Bihar, Uttar Pradesh, West Bengal, and Uttarakhand – spanning over 1,850 kilometres.

VALUE ADDITION:

- Kali river or Sharda River, it originates at Kalapani in the Himalayas at an elevation of 3,600 m (11,800 ft) in the Pithoragarh district in Uttarakhand, India. It flows along Nepal’s western border with India and has a basin area.

- Its major tributaries are the Dhauliganga, Goriganga, and Sarju. The Sarda Barrage (dam), near Banbasa (Uttarakhand), is the source of the Sarda Canal (completed 1930), one of the longest irrigation canals in northern India. It joins Ghaghra River, a tributary of the Ganges.

- NOTE: The Pancheshwar multipurpose dam project, is on the Kali river.

THE ENVIRONMENT AND ECOLOGY

2. INDIA ADDS TWO NEW RAMSAR SITES

THE CONTEXT: On World Wetlands Day, 2022 (2nd February ) India added two Ramsar sites upscaling the number from 47 to 49.

THE EXPLANATION:

- The Khijadia Wildlife Sanctuary in Gujarat and Bakhira Wildlife Sanctuary in Uttar Pradesh are the latest Ramsar sites to join the list of protected wetlands in the country.

- World Wetlands Day 2022 theme is ‘Wetlands Action for People and Nature,’ which highlights the importance of actions to ensure the conservation and sustainable use of wetlands for humans and planetary health.

- All 49 Ramsar Sites together now cover 10,93,636 Ha, making it the highest in South Asia. Bakhira Wildlife Sanctuary offers a safe wintering and staging ground for a large number of special Central Asian Flyway while Khijadia Wildlife Sanctuary is a coastal wetland with rich avifaunal diversity. It provides a safe habitat to endangered and vulnerable species.

- The original Wetland Atlas was released in 2011. The decadal change atlas highlights the changes which have happened in wetlands across the country.

Value Addition:

What is Ramsar Sites?

- Any wetland site which has been listed under the Ramsar Convention that aims to conserve it and promote sustainable use of its natural resources is called a Ramsar Site.

- Ramsar Convention is known as the Convention of Wetlands. It was established in 1971 by UNESCO and came into force in 1975.

- India is a party to the Ramsar Convention. India signed under it on 1st February 1982.

| What is Montreux Record?

· The Montreux Record is a register of wetland sites on the List of Wetlands of International Importance where changes in ecological character have occurred, are occurring, or are likely to occur as a result of technological developments, pollution or other human interference. · Currently, two wetlands of India are in Montreux record: Keoladeo National Park (Rajasthan) and Loktak Lake (Manipur). · Chilika lake (Odisha) was placed in the record but was later removed from it. |

- Contracting Parties are expected (but not mandated) to manage their Ramsar Sites so as to maintain their ecological character and retain their essential functions and values for future generations.

- The convention specifies that “Contracting Parties shall (not may) formulate and implement their planning so as to promote the conservation of the wetlands included in the List”.

- The Changwon Declaration on human well-being and wetland 2008 – It highlights positive action for ensuring human well-being and security in the future under the themes – water, climate change, people’s livelihood and health, land use change, and biodiversity.

- Many important wetlands extend as one ecologically coherent whole across national borders. In these cases,COP can agree to establish Ramsar Sites on their territory as parts of a bigger Transboundary Ramsar Site.

The Ramsar Convention works closely with six organizations known as International Organization Partners(IOPs). These are:

- Birdlife International

- International Union for Conservation of Nature (IUCN)

- International Water Management Institute (IWMI)

- Wetlands International

- World Wide Fund for Nature (WWF)

- International Wildfowl & Wetlands Trust (WWT)

Prelims Perspective:

- Uttar Pradesh (10) has the maximum number of Wetlands in India.

- Sundarbans is the largest Ramsar Site of India (Added in 2019).

- Renuka Wetland (Area – 20 ha) in Himachal Pradesh is the smallest wetland of India.

- Chilika Lake (Orissa) and Keoladeo National Park (Rajasthan) were recognized as the first Ramsar Sites of India.

- The world’s first site was the Cobourg Peninsula in Australia, designated in 1974.

- The countries with the most Ramsar Sites are the United Kingdom with 175 and Mexico with 142.

- Bolivia has the largest area under Ramsar protection.

THE ECONOMIC DEVELOPMENT

3. SRI LANKA SIGN $500-MILLION LOAN AGREEMENT

THE CONTEXT: The Export Import Bank (EXIM) of India and the Government of Sri Lanka on signed a $500- million Line of Credit agreement aimed at helping Sri Lanka cope with its current fuel shortages, amid one of the worst economic meltdowns facing the island nation.

THE EXPLANATION:

- According to a statement from the Indian High Commission in Colombo, India’s support for fuel imports through the Line of Credit, is in response to Colombo’s “urgent requirement”.

- Recently, India extended a $400 million currency swap to Sri Lanka, while also deferring another $500 million due for settlement to the Asian Clearing Union (ACU), to help the island nation cope with its dollar crunch.

- Further to the $900 million extended then, and the emergency credit for fuel imports now, both governments are in talks for another $ 1 billion assistance that Colombo has sought from New Delhi, at a time when the island nation faces an unprecedented economic crisis.

What is Line of Credit?

- The Government of India is reasonably satisfied with the progress in the implementation of Lines of Credit supported by India in foreign nations over the past 3 years.

- The Line of Credit is not a grant but a ‘soft loan’ provided on concessional interest rates to developing countries, which has to be repaid by the borrowing government.

Value Addition:

- Exim Bank was established under the Export-Import Bank of India Act, 1981 as a purveyor of export credit, mirroring global Export Credit Agencies. Exim Bank serves as a growth engine for industries and SMEs through a wide range of products and services.

- This includes import of technology and export product development, export production, export marketing, pre-shipment and post-shipment and overseas investment.

- Exim Bank extends Lines of Credit (LOCs) to overseas financial institutions, regional development banks, sovereign governments and other entities overseas, to enable buyers in those countries to import developmental and infrastructure projects, equipment, goods and services from India, on deferred credit terms.

THE PRELIMS PRACTICE QUESTIONS

QUESTION OF THE DAY 3rd FEBRUARY 2022

Q. Consider the following statements about Ramsar Convention:

- Contracting Parties are mandated to manage their Ramsar Sites so as to maintain their ecological character.

- Contracting Parties shall formulate and implement their planning so as to promote the conservation of the wetlands included in the Ramsar List.

- There is no provision to establish transboundary Ramsar site between more than one nation.

Which of the given statements are incorrect?

a 1 and 2 only

b 2 and 3 only

c 1 and 3 only

d 1, 2 and 3

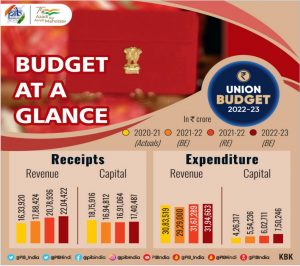

ANSWER FOR 2nd FEB 2022

Answer: b

Explanation:

- Statement 1 is incorrect: Indira Gandhi was first woman minister to present budget in India, Nirmala Sitaraman is second woman.

- Statement 2 is correct: Morarji Desai had presented maximum number (10 times) of budgetsso far.

- Statement 3 is correct: Railway budget was merged with Union budget in 2017 (Arun Jaitleywas Finance Minister).