DAILY CURRENT AFFAIRS (JANUARY 06, 2022)

THE INDIAN ECONOMY

1. BIOENERGY CROPS CREATE A COOLING EFFECT ON CULTIVATED AREAS

THE CONTEXT: Researchers found that global air temperature decreases by 0.03~0.08 °C, with strong regional contrasts and inter-annual variability, after 50 years of large-scale bioenergy crop cultivation.

THE EXPLANATION:

- The researchers — led by Institute for Global Change Studies, Beijing — looked at the biophysical climate effects of large-scale bioenergy crops to fully assess their role in climate mitigation.

- According to a new study, converting annual crops to perennial bioenergy crops can induce a cooling effect on the areas where they are cultivated.

- Cultivation area under bioenergy crops occupies 8 percent ± 0.5 percent of the global total land area, but they exert strong regional biophysical effects, leading to a global net change in air temperature of −0.08 ~ +0.05 degrees Celsius.

- The study also demonstrated the importance of the crop type choice, the original land use type upon which bioenergy crops are expanded, the total cultivation area and its spatial distribution patterns.

Importance:

- The biophysical cooling or warming effects of bioenergy crop cultivation can significantly strengthen or weaken the effectiveness of bioenergy crop cultivation with carbon capture and storage (BECCS) in limiting the temperature increments, depending on the cultivation map and the bioenergy crop type.

- Large-scale bioenergy crop cultivation induces a biophysical cooling effect at the global scale, but the air temperature change has strong spatial variations and inter-annual variability.

- Cultivating eucalypt shows generally cooling effects that are more robust than if switchgrass is used as the main bioenergy crop, implying that eucalypt is superior to switchgrass in cooling the lands biophysically.

- Replacing forests with switchgrass not only results in biophysical warming effects but could also release more carbon through deforestation than converting other short vegetation to bioenergy crops.

- Deforestation, therefore, should be avoided. The magnitude of changes in the biophysical effects also depends on the total area under cultivation.

What are Bioenergy Crops?

- Bioenergy crops are defined as any. plant material used to produce bioenergy. These crops have the capacity to produce large volumes of biomass, have high energy potential, and can be grown in marginal soils.

- It is a renewable source of energy that is produced from plants and animals. … Some forms of bioenergy have been around for a long time. Examples include burning wood to create heat, using biodiesel and ethanol to fuel vehicles, and using methane gas and wood to generate electricity.

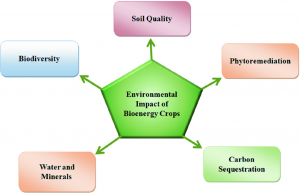

Impacts on Environment:

2. SIX ONE DISTRICT ONE PRODUCT BRANDS LAUNCHED UNDER THE PMFME

THE CONTEXT: The Union Ministry of Food Processing Industries launched six, One District One Product (ODOP) brands under the Pradhan Mantri Formalizations of Micro food processing Enterprises (PMFME) Scheme.

THE EXPLANATION:

- The Ministry of Food Processing Industries has signed an agreement with NAFED for developing 10 brands of selected ODOPs under the branding and marketing component of the PMFME scheme. Out of these, six brands namely Amrit Phal, Cori Gold, Kashmiri Mantra, Madhu Mantra, Somdana, and Whole Wheat Cookies of Dilli Bakes.

- Through this initiative under the PMFME scheme, the Ministry of Food Processing Industries aims to encourage the micro food processing enterprises (MFPEs) across the country about the vision, efforts, and initiatives of the Government to formalise, upgrade and strengthen them and take them a step closer to Aatmanirbhar Bharat.

Value Addition:

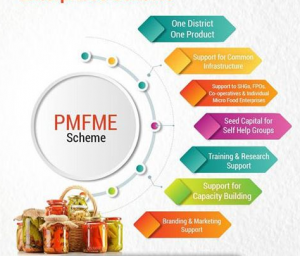

PMFME Scheme

- The PMFME Scheme is a centrally sponsored scheme that aims to enhance the competitiveness of existing individual micro-enterprises in the unorganized segment of the food processing industry.

- It aims to enhance the competitiveness of existing individual micro-enterprises in the unorganized segment of the food processing industry and promote formalization of the sector,

- It further aims to promote formalization of the sector and provide support to Farmer Producer Organizations, Self Help Groups, and Producers Cooperatives along their entire value chain.

- The scheme envisions to directly assisting the 2,00,000 micro food processing units for providing financial, technical, and business support for the up-gradation of existing micro food processing enterprises.

A major component of the scheme

One District One Product

- Under the One District One Product (ODOP) component of the PMFME Scheme, the Ministry of Food Processing Industries approved ODOP for 137 unique products.

- The GIS ODOP digital map of India has been launched to provide details of ODOP products of all the States and UTs.

- The digital map also has indicators for Tribal, SC, ST, and aspirational districts.

- It will enable stakeholders to make concerted efforts for its value chain development.

About NAFED:

- National Agricultural Cooperative Marketing Federation of India Ltd.(NAFED), established in 1958, is registered under the Multi State Co-operative Societies Act.

- Nafed was setup with the object to promote Co-operative marketing of Agricultural Produce to benefit the farmers.

- The objectives of the NAFED shall be to organize, promote and develop marketing, processing and storage of agricultural, horticultural and forest produce, distribution of agricultural machinery, implements and other inputs, undertake inter-state, import and export trade etc.

THE ENVIRONMENT ECOLOGY AND CLIMATE CHANGE

3. THE NEW RULES ON FLY ASH DISPOSAL

THE CONTEXT: The notification from the Union Ministry of Environment, Forest and Climate Change intends to “bring out a comprehensive framework for ash utilization including a system of environmental compensation based on the polluter-pays principle”.

THE EXPLANATION:

The New Rule highlights:

- It is mandatory for Thermal Power Plants (TPPs) to ensure 100% utilization of fly ash within three to five years.

- Existing provisions allow TPPs to fully utilize fly ash in a four-year cycle in a staggered manner.

- It also introduced fines of Rs 1,000 on non-compliant plants under the ‘polluter pays principle’, taking into account utilization targets from April 1, 2022.

- The ‘polluter pays principle is the commonly accepted practice that those who produce pollution should bear the costs of managing it to prevent damage to human health or the environment.

- Under this, the collected fines will be deposited in the designated account of the Central Pollution Control Board (CPCB).

- The fine collected by CPCB from the TPPs and other defaulters shall be used towards the safe disposal of the unutilized ash.

- It also deals with unutilized accumulated ash (legacy ash) where TPPs will have to utilize it within 10 years from the date of publication of final notification in a staggered manner.

- If the utilization of legacy ash is not completed at the end of 10 years, a fine of Rs 1000 per tons will be imposed on the remaining unutilized quantity which has not been fined earlier.

BACKGROUND:

- India has over 200 coal power plants that generate an enormous amount of fly ash. According to the Central Electricity Authority, India’s coal plants generated 232.56 million tonnes of fly ash in 2020-2021. Although 93 percent of it was utilized, millions of tonnes accumulated over the years lie unused.

- A study by the think tank Centre for Science and Environment in March 2021 found that over half of India’s power plants failed to fully utilize their fly ash and fell behind previous government targets.

- The new notification will replace the 1999 notification that had originally set up rules for fly ash utilisation. It will also supersede the various amendments to the 1999 notification made in 2003, 2009 and 2016, which have all sought to manage the generation of fly ash.

What do experts say?

- According to experts, the introduction of a penalty for non-compliance and acknowledgment of legacy ash is a step in the right direction, but there are other facets that the notification doesn’t adequately address.

- “The notification calls the filling of low-lying areas an eco-friendly method of utilizing fly ash, but more often than not, this is a euphemism for irresponsibly dumping ash. Dumping ash in low-lying areas can lead to severe ecological consequences.

- A report found that there were eight major fly ash breaches between 2019 and 2021, leading to destruction and contamination.

- While the notification says that all yearly and legacy ash must be utilized, it also makes a provision for ash stored in dykes and ponds — structures built for large amounts of ash disposal — saying that as long as such storage is “stabilized” or reclaimed by growing plantations, coal power plants certified with the CPCB can be excluded from the 10-year deadline.

- “It is critical to take policy measures to link fly ash utilization with steps being taken by the government to prevent diseases and deaths and provide health services. The environmental regulation that emerges from this approach of ‘fly ash as a health risk’ has the potential to identify remedies to address the legacy impact and prevent future legal breaches.

Value Addition:

What is Fly Ash?

- Fly ash is a byproduct of burning pulverized coal in thermal power plants.

- During combustion, mineral impurities in the coal (clay, feldspar, quartz, and shale) fuse in suspension and float out of the combustion chamber with the exhaust gases. As the fused material rises, it cools and solidifies into spherical glassy particles called fly ash.

- The low-grade coal used in thermal power generation carries 30-45% ash content. The high-grade imported coal has a low ash content of 10-15%.

- Since most of the coal used in thermal plants is low-grade, it generates a large quantity of ash which requires a large area as landfill or ponds for disposal.

- All fly ashes exhibit cementitious properties to varying degrees depending on the chemical and physical properties of both the fly ash and cement.

Composition:

- Depending upon the source and composition of the coal being burned, the components of fly ash vary considerably, but all fly ash includes substantial amounts of silicon dioxide (SiO2), aluminum oxide (Al2O3) and calcium oxide (CaO), the main mineral compounds in coal-bearing rock strata.

- Minor constituents include arsenic, beryllium, boron, cadmium, chromium, hexavalent chromium, cobalt, lead, manganese, mercury, molybdenum, selenium, strontium, thallium, and vanadium, along with very small concentrations of dioxins and PAH compounds. It also has unburnt carbon.

Applications:

- It is an excellent material for making construction materials such as bricks, mosaic tiles and hollow blocks.

- Bricks made of fly ash can help conserve soil to a great extent.

- There are several eco-friendly ways to utilize fly ash so that it does not pollute air and water.

- It includes the use of fly ash in the manufacturing of cement, ready-mix concrete; constructing roads, dams and embankments, and filling of low-lying areas and mines.

Health and environmental hazards:

- Toxic heavy metals present: All the heavy metals found in fly ash nickel, cadmium, arsenic, chromium, lead, etc—are toxic in nature. They are minute, poisonous particles that accumulate in the respiratory tract, and cause gradual poisoning.

- Radiation: For an equal amount of electricity generated, fly ash contains a hundred times more radiation than nuclear waste secured via dry cask or water storage.

- Water pollution: The breaching of ash dykes and consequent ash spills occur frequently in India, polluting a large number of water bodies.

- Effects on the environment: The destruction of mangroves, drastic reduction in crop yields, and the pollution of groundwater in the Rann of Kutch from the ash sludge of adjoining Coal power plants has been well documented.

THE DISASTER MANAGEMENT

4. THAILAND’S NEW EARLY WARNING TECHNOLOGY

THE CONTEXT: A new early warning and hazard monitoring system, ThaiAWARE, will provide advanced decision support capabilities to Thailand’s disaster managers, protecting the country’s 70 million residents from natural disasters.

THE EXPLANATION:

- Thailand is prone to natural disasters, such as floods, droughts and tropical storms.

- The country suffered an economic loss to the tune of $46,055,161 due to natural disasters from 2009-2018.

- The National Disaster Relief Centre has indicated that flood disasters in Thailand between 1989 and 2018 caused more than B160.8 billion ($5.1 billion) in damage to the economy. The 2011 floods accrued economic damage of more than B23 billion ($0.7 billion) alone.

- Thailand’s Disaster Prevention and Mitigation Department (DDPM) reported that flooding affected 229,220 households across 6,827 villages in 193 districts of 31 provinces, as of September 2021.

- According to the Thailand Department of Disaster Prevention and Mitigation, 32 of the country’s 76 provinces have been affected by flooding in October 2021. In late September and early October 2021 , tropical storm Dianmu inundated the region, leading to flash flooding.

THE PRELIMS PRACTICE QUESTION

Q1. Bisphenol A (BPA), a cause of concern, is a structural/key component in the manufacture of which of the following kinds of plastics?

a) Low-density polyethylene

b) Polycarbonate

c) Polyethylene terephthalate

d) Polyvinyl chloride

ANSWER FOR 04TH JANUARY 2022

ANSWER: A

Explanation:

Dholavira: a Harappan city, is one of the very few well preserved urban settlements in South Asia dating from the 3rd to mid-2nd millennium BCE. Being the 6th largest of more than 1,000 Harappan sites discovered so far, and occupied for over 1,500 years, Dholavira not only witnesses the entire trajectory of the rise and fall of this early civilization of humankind, but also demonstrates its multifaceted achievements in terms of urban planning, construction techniques, water management, social governance and development, art, manufacturing, trading, and belief system. With extremely rich artifacts, the well-preserved urban settlement of Dholavira depicts a vivid picture of a regional center with its distinct characteristics, that also contribute significantly to the existing knowledge of Harappan Civilization as a whole.

The property comprises two parts: a walled city and a cemetery to the west of the city. The walled city consists of a fortified Castle with attached fortified Bailey and Ceremonial Ground, and a fortified Middle Town and Lower Town. A series of reservoirs are found to the east and south of the Citadel. The great majority of the burials in the Cemetery are memorial in nature.